Events

Events Calendar

RMIA SA/NT Chapter Risk Cuppa | Advice from the regulator: Psychosocial Risk

Event Details

Time: 12:00 pm - 1:00 pm ACDT

Date: 24 February 2026

Venue: Online

Registration Fee: Free

About the Event

SA/NT chapter Risk Cuppas are back for 2026, and our first event was the most requested topic last year – Psychosocial Risk. Join Safework SA’s Workplace Advisory Team, to learn what organisations are doing well, and not so well, in their efforts to create psychologically safe workplaces. The team will share information about their services and resources, and bring practical insight into your most burning psychosocial risk questions. Make a cuppa and join this virtual session to sharpen your knowledge on this complex and emerging area of risk.

About the Speaker

Katie Geszner

Education and Engagement Advisor, SafeWork SA

Katie is a professional educator with first class development and communication experience. Adept at creating engaging, accessible learning experiences across diverse platforms and audiences. Works productively and effectively in a structured and deadline focused workplace where upgrading of skills is mandatory. Personable, efficient and multi-skilled with exacting attention to detail. Positive and results orientated.

Moderator

Joel Sibbin

SA/NT Chapter Committee Executive

Joel is a Risk Management Speciality at ASC Pty Ltd and has previously held role in Risk and Business Continuity roles within Federal Government. His previous experience in the education, financial services and government sectors, has enabled a people-centric focus and collaborative approach to the design and implementation of projects, frameworks and education programs. He won RMIA’s Student of the year for 2022, and has been an SA/NT RMIA SA/NT chapter committee member since 2022.

RMIA QLD Chapter | 2026 Kick Start Event

Event Details

Time: 5:00pm - 7:00pm AEST

Date: 24 February 2026

Venue: Port Office Hotel | 40 Edward St, Brisbane City QLD 4000, Australia

Registration Fee: Free

An RMIA networking event bringing together Queensland risk professionals to reconnect, share perspectives, and collectively set the tone for the year ahead within the RMIA community.

Hosted by: Michelle Holland

President Qld Chapter

Note: As part of our ongoing commitment to provide valuable connections, we would like to inform you that the contact information provided during registration may be shared with our event sponsors. This is in accordance with our privacy policy and will be done solely for the purpose of fostering professional engagement and collaboration opportunities.

Event Sponsor

SAI360 Webinar | Bridging the Gap: Aligning Enterprise Risk and Compliance in Highly Regulated Industries

Event Details

Time: 11:00 am - 12:00 pm AEDT

Date: 25 February 2026

Venue: Online

Registration Fee: Free

CPD point(s): 1 point (For RMIA members)

About Event

The cost of non-compliance is rising. The real business impact extends beyond financial penalties, including business disruption, lost revenue, reputational fallout, and ongoing regulatory scrutiny. Preparation carries a price, but it’s dwarfed by the cost of failure.

Australia's regulators have high expectations for firms’ non-financial risk management practices and risk culture, aligning on one key expectation: integration. Siloed risk functions create blind spots, reduce efficiency, and expose firms. What’s emerging is a regional consensus that risk must be embedded across all levels of decision-making.

With APRA’s CPS 230 coming into force, financial institutions must integrate operational risk, business continuity, and third-party risk management into a unified framework. CPS 230 calls for cultural change, demanding risk be proactively identified, assessed, and managed across the enterprise.

In this webinar, we’ll explore:

The real cost of non-compliance — how regulatory failures impact revenue, operations, and reputation.

Why do siloed functions fail?

How can firms close the gap between risk and compliance to improve efficiency, resilience, and oversight?

What integrated risk and compliance looks like in practice — from board-level accountability to operational execution.

How technology can enable a connected GRC strategy — using modern platforms to embed risk-aware decision-making and prepare for crisis scenarios.

About the Speakers

Sean Faherty

GRC Technology Specialist and BDM

Sean has spent 14 years in Corporate and Investment Banking with one of the world’s largest financial institutions, developing deep expertise in complex financial solutions, client management, and global banking operations. For the past nine years, he has supported major APAC companies in strengthening their global Risk and Compliance programs, enhancing governance frameworks, improving risk visibility, and helping them manage regulatory obligations effectively.

Ben Burnet

Global Ethics, Governance, Risk & Compliance Technology Strategist | SAI360

Ben Burnet is an EGRC Strategist with a global focus on governance, risk, and compliance (GRC). He works closely with organizations worldwide to strengthen their understanding of modern risk landscapes, navigate evolving regulatory requirements, and adopt responsible approaches to AI. Ben’s work is centered on helping enterprises modernize and future proof their risk and compliance programs as they prepare for the challenges of 2026 and beyond.

Note: As part of our ongoing commitment to provide valuable connections, we would like to inform you that the contact information provided during registration may be shared with our event sponsors. This is in accordance with our privacy policy and will be done solely for the purpose of fostering professional engagement and collaboration opportunities.

Risk 2 Solution | Graduate Certificate in Organisational Resilience, Risk and High Reliability (11056NAT) | Unit 1 schedule

Course Details

For more information on the course, please click here.

Duration:

The course runs for four units, online sessions, followed by independent study time to complete assessments.

Venue:

Online

2026 Dates:

Unit 1 - 27 Feb - 2 March 2026

Unit 2 - 10 - 13 April 2026

Unit 3 - 15 - 18 May 2026

Unit 4 - 26 - 29 June 2026

Costs:

RMIA Members $8,775.00 (incl GST)

Non-Members: $9,125.00 (incl GST)

CPD Points:

30 points

A Year in the Life: with Rodney Young | RMIA Risk Award Winner | Risk Leader of the Year - APAC Region

Event Details

Time: 12:00pm - 1:00pm AEDT

Date: 27 February 2026

Venue: Online (an invite will be sent close to the date)

Registration Fee: Free

Jane Whiter, RMIA President (Left) | Rodney Young, RMIA Risk Award Winner (Center), Simon Levy, RMIA CEO (Right)

About the Event

Join RMIA CEO Simon Levy for an engaging conversation with Rodney Young, as he reflects on his journey following recognition as an RMIA Risk Award winner. This interactive webinar will explore how the award has elevated Rodney’s professional profile and influenced his ongoing contributions to the risk management profession.

Rodney will share the story behind his award-winning submission, the challenges he navigated along the way, and the key lessons learned throughout the process. Participants will gain practical insights into what makes a strong submission, along with Rodney’s advice for future nominees looking to showcase excellence and impact in risk management.

Whether you’re aspiring to be an RMIA Risk Award winner, curious about the professional impact of this prestigious recognition, or simply seeking inspiration from an experienced risk leader, this is a conversation not to be missed.

A Year in the Life: with Richard Ellis | RMIA Risk Award Winner | Public Sector Risk Leader of the Year

Event Details

Time: 12:00pm - 1:00pm AEDT

Date: 4 March 2026

Venue: Online (an invite will be sent close to the date)

Registration Fee: Free

Left to right: Jane Whiter, RMIA President; Richard Ellis, RMIA Risk Award Winner; Mark Caton, Riskonnect Representative; Simon Levy, RMIA CEO.

About the Event

Join RMIA CEO Simon Levy for a thoughtful conversation with Richard Ellis, as he shares reflections on his journey as an RMIA Risk Award winner. In this interactive webinar, Richard will discuss how the recognition has shaped his professional growth and supported his continued contribution to the risk management community.

Richard will share insights into the thinking behind his award-winning submission, reflect on key challenges encountered, and highlight key learnings from the experience. Attendees will gain practical guidance on what assessors look for in a compelling submission, along with Richard’s advice for future nominees seeking to demonstrate impact and leadership in risk management.

Whether you’re considering submitting for an RMIA Risk Award, interested in the career impact of industry recognition, or keen to learn from a respected risk professional, this session offers valuable perspective and inspiration.

Adaptive Cultures | Workshop | The Risk Culture Paradox: Making Progress on the Risk Agenda in Complex Environments

Event Details

Date: 5 & 12 March 2026 (Two Half Days)

Time: 9:00 am - 12:00 pm

Delivery: Online

Registration fee:

Member $880 incl GST

Non-member $1100 incl GST

CPD Points: 8

About Event

CROs and their teams have invested heavily in building risk management capabilities and implementing frameworks such as 3LOD. Yet there remains a significant disconnect between the quality of risk capabilities and the quality of risk outcomes – well documented by the Hayne Royal Commission and underscored frequently by headlines in the financial and business press.

In an effort to address this disconnect, CROs and their teams are turning their attention to risk culture - how culture influences risk management and risk outcomes.

In these two interactive workshops for CROs and Senior Risk Leaders, Adaptive Cultures facilitates an exploration of the challenges to deepening risk ownership and embedding quality risk practices, and participants will develop strategies they can implement in their organisations to improve risk culture. Topics include:

the core qualities and capabilities that support influence on risk topics,

approaches to broaden and deepen risk ownership,

what’s working well and less well in the 3LOD framework and FAR implementation,

ways to complement structural risk tools with adaptive methods that can create a truly embedded risk framework, and

how to engage executive peers more fully in this work.

About the Trainers

DeAnna Burton

Adaptive Cultures - Risk Culture Practice Lead

DeAnna works with organisations and leaders to deepen the alignment of risk management, risk culture, and risk outcomes. She has over 20 years' financial services experience in Australia and the US in a variety of business arenas, including culture integration for a complex merger, designing a risk culture framework and initiatives to uplift risk culture maturity, survey design, senior leadership development programs and coaching.

Andrew Brown

Adaptive Cultures – Director and Co-Founder

Andrew is a director and co-founder of Adaptive Cultures. He has lectured, written, worked and consulted extensively in the field of risk management and risk culture. He believes that how we think about (and what we believe about) risk and consequences has a profound impact on ourselves, our organisations, our society and our planet. Andrew has held executive positions across the Asia Pacific region. These include Chief Actuary for AXA Life Singapore, Chief Financial Officer for Philippine AXA Life.

Note: As part of our ongoing commitment to provide valuable connections, we would like to inform you that the contact information provided during registration may be shared with our event sponsors. This is in accordance with our privacy policy and will be done solely for the purpose of fostering professional engagement and collaboration opportunities.

RMIA NSW Chapter Risk Cuppa | Women in Risk

Event Details

Time: 12:30 pm - 1:30 pm AEDT

Date: 25 February 2026

Venue: Online

Registration Fee: Free

CPD point(s): 1 point (For RMIA members)

About Event

In recognition of International Women’s Day 2026, the Women in Risk event brings together members of the risk community to hear from two experienced risk professionals as they reflect on their career journeys.

Our speakers will share practical insights into the challenges they’ve faced, the successes they’ve achieved, and the lessons they’ve learned along the way. The discussion will explore how professionals can navigate the risk management field, build expertise, and develop as trusted subject matter specialists within their industries.

This session offers an opportunity to hear honest perspectives, gain practical takeaways, and connect with others working across the risk profession.

About the Guest Speakers

Jen Creaton

Executive Manager Risk, Commercial & Personal Injury Insurance | Suncorp Group

Jen Creaton is a senior risk professional with extensive experience in business roles across risk management, assurance, and compliance within large financial services organisations. She currently leads the Commercial and Personal Injury Insurance risk function, providing oversight and ensuring effective risk frameworks, governance, and regulatory compliance.

Jen has held senior leadership roles across Suncorp Group, spanning consumer, commercial, and statutory portfolios. She has partnered closely with executive and operational leaders to strengthen risk capability, enhance control environments, and manage emerging and strategic risks.

Recognised for her practical and commercial approach, Jen is adept at translating complex risk and compliance requirements into clear, value-driven outcomes. She also serves as a Director on the Board of the Brisbane Racing Club, contributing her expertise in risk, governance, and business leadership.

Kate Gannon

Director | August Advisory

Energetic and creative, with a focused and pragmatic approach to problem solving, Kate brings two decades of experience consulting to, and working for, global and regional financial services businesses in London and Australia. She is a strong change agent with an ability to think both ahead and on her feet whether she is designing frameworks or leading teams through ambiguity or crisis.

She founded her own consulting practice, August Advisory, in 2021 after identifying a gap in the market for risk advisory support for purpose-based organisations. These organisations needed ‘match-fit’ resources to help them drive maturity where capacity and capability issues left them short. And then in 2025, she founded ResilienceSOS®, a bold strategic operating system that turns resilience from a compliance chore into a team sport. Blending behavioural science, change strategy, and creative thinking, it helps leaders, teams & organisations by giving them the language, tools and training to embed resilience where it counts - in everyday action.

Kate has built expertise across the spectrum of risk disciplines. This includes the design and implementation of risk appetite statements, profiles, frameworks, and policies – coupled with supporting organisations to seed and grow a risk culture mindset & movement. She is known for her straight-talking approach and for her ability to distil complexity into simplicity.

Kate was also recognised as RMIA's 2025 Risk Consultant of the Year, has a Bachelor’s degree in Commerce and Economics from the University of Queensland, is a chartered accountant, and a graduate of the Australian Institute of Company Directors.

When Kate is not doing risky things, she can be found learning some new skills (like AI or cycling) or at the beach or sport with her teenage sons

A Year in the Life: with Sandra Hinchcliffe | RMIA Risk Award Winner | Risk Student of the Year

Event Details

Time: 12:00pm - 1:00pm AEDT

Date: 12 March 2026

Venue: Online (an invite will be sent close to the date)

Registration Fee: Free

About the Event

Join RMIA CEO Simon Levy for a thoughtful conversation with RMIA Risk Award winner Sandra Hinchcliffe, as she reflects on her professional journey and the impact of receiving the award. In this interactive webinar, Sandra will share how the recognition has influenced her career growth and supported her ongoing contribution to the risk management community.

Sandra will also offer insights into the thinking behind her award-winning submission, reflect on key challenges encountered, and highlight important learnings from the experience. She will provide practical guidance on what assessors look for in a strong submission, along with her advice for future nominees seeking to demonstrate impact and leadership in risk management.

Whether you’re considering submitting for an RMIA Risk Award, curious about the career impact of industry recognition, or keen to learn from an experienced risk professional, this session offers valuable perspective and inspiration.

BWC | Enterprise Risk Management with Lauren Jones

Course Details

Duration: AEDT (UTC+11:00)

SESSION 1 (4 hours)

09:00am - 1:00pm - Thursday 19 March 2026

SESSION 2 (4 hours)

09:00am - 1:00pm - Friday 20 March 2026

Costs:

RMIA Members $1,875.00 (incl GST)

Non-Members $2,500.00 (incl GST)

CPD Points: 12

Welcome to the Enterprise Risk Management course, RMIA's signature course and a certification pre-requisite presented by our Training Partner, Bryan Whitefield Consulting.

About

All organisations, no matter whether private, government or not-for-profit have one thing in common – they all take risk to achieve their goals.

Unfortunately, too many organisations either don’t have any formal approach to considering the risks they are taking, or they utilise forms of risk management that are below par. That is, they are not in line with the principles and guidelines of better practice as defined in AS ISO 31000.

The purpose of the course is to provide you with the requisite knowledge to design, implement and operate enterprise risk programs for the successful management of organisational risk.

Course Overview

Introducing AS ISO 31000:2018

The course is aligned to the international standard on risk.

The standard is a guideline for any organisation that can be adapted to suit the needs of the organisation.

It provides principles, framework and process for managing organisational risk.

Learning Objectives

Understand the principles that underlie an efficient and effective approach to the management of organisational risk and the value it brings to the organisation.

Understand the core elements and benefits of a framework for integrating risk management into the governance and operations of an organisation.

Understanding of the risk management process and how to apply it to organisations of differing size and complexity.

Format of the Course

Please note that this course is now being delivered online. Attendees will receive a zoom invitation to participate in the 'face-to-face' aspect of the course online after registering. We can assure you that despite being online, we provide a high quality experience presented by Bryan Whitefield, a leader in the risk industry and a certified virtual presenter. To view testimonials on the success of Bryan's online RMIA tutorials here.

One Day Online Self-Paced Learning - Develop a technical understanding of ISO 31000

Two Half Day Online Learning Workshops facilitated by Lauren Jones

Clarify and embed technical understanding of ISO 31000

Tips and tricks on enterprise risk management including on:

Assessing the quality of an organisation’s approach to risk

What makes a good risk assessment

The key to communicating and consulting on risk

About the Trainer

Lauren Jones

Trainer, Bryan Whitefield Consulting

Lauren Jones is a facilitator, trainer and expert in helping leaders build sustainable businesses, with over 30 years of experience working with C level executives, business owners and leaders. Her experience specialising in strategic facilitation, skills development, systems implementation and continual improvement for organisations has increased clarity and focus on outcomes, built efficiency and increased profitability with her clients.

Over the past decade Lauren has facilitated numerous risk workshops and has designed and implemented risk management programs for a multitude of organisations across diverse industries such as construction, infrastructure and manufacturing.

Lauren has authored a recently released book: 10% BETTER: Taking Organisations from Ordinary to Excellent written for leaders who want to build resilience for their organisations to sustain change and challenge, and be a legacy into the future. For more information on Lauren you can email her on lauren@laurenjones.com.au or visit her website www.laurenjones.com.au

Group Bookings: For Group Bookings, please contact us via email on pdp@rmia.org.au or by phone on 1300 775 648.

RMIA Accreditation Pathway: Upon completion of the RMIA's Enterprise Risk Management course, participants will be eligible to sit the exam to become a Certified Practising Risk Associate (CPRA®) or the Certified Practising Risk Manager (CPRM®) accreditation. To apply for Certification click here.

When you register for this course you agree to the RMIA passing your registration details onto our Training Partner, Bryan Whitefield Consulting.

BWC | Persuasive Adviser Program

Course Details

Duration: AEDT (UTC+11:00)

SESSION 1 (4 hours)

09:00am - 13:00pm Thursday, 26 March 2026

SESSION 2 (4 hours)

09:00am - 13:00pm Friday, 27 March 2026

Costs:

RMIA Members $990.00 incl GST

Non-Members $1,320.00 incl GST

The average piece of business advice to an executive takes about 8 hours of your and your team’s time to prepare and 15 minutes to deliver.

Those 15 minutes simply cannot be wasted.

About

RMIA is proud to bring the risk community Bryan Whitefield’s Persuasive Adviser Program, which has been delivered successfully to full-houses across the public, private and not-for-profit sectors.

The Persuasive Adviser Program tackles the challenge risk advisers, practitioners and managers have with getting their message and key advice through to their stakeholders.

It will give risk practitioners all you will need to make the difference you know you can make, so you can create the change that is needed in your organisations.

Join the Persuasive Adviser Program to learn practical tools and techniques that will enable you to influence your stakeholders as a trusted Adviser and have a greater impact on outcomes.

Every attendee to the Persuasive Adviser Program will get a complimentary copy of Bryan Whitefield’s book, Winning Conversations: How to Turn Red Tape Into Blue Ribbon.

Course Overview

Perceptions of internal advisers

Achieving Persuasive Adviser status

The Pathfinder Model

Why decision making can be improved

MCI - Motivation - Clarification - Implementation

Stand – Paint – Tell – Make

How to stand in your internal client’s shoes

How to paint them a picture

How to tell them a story

How to make them believe

Action Plan

Developing your toolbox

Planning your journey

Making yourself accountable

One of the most common complaints Bryan hears from internal advisers of all kinds (admin, finance, HR, IT, risk, compliance, procurement and audit as examples) is that it is often difficult to get some business leaders to listen to them and even harder to get them to act on their advice. He hears things like:

“Sometimes I feel like I am there just to keep them out of trouble with the boss, they don’t really see me as a key adviser.”

“It is because what I do is not sexy like sales or marketing (private sector)/like the Minister’s favourite program (public sector).”

“If I was the CEO they would sit up and listen!”

While all of these comments are examples of the challenges internal advisers need to overcome to cut through with their advice, they are not the cause. There is more going on.

For starters, most advisers have to be a corporate cop from time to time. They have to say to the business that certain policies, frameworks, and processes have to be followed. Worse still, sometimes advisors have to report a problem when the business has not done the right thing.

It then makes it very hard to turn around the next day and say to a business leader, "I am your trusted adviser on this and you should heed my advice."

The imperative for an internal adviser is to solve problems for your internal clients. The way to do that is to stand in their shoes, understand their problems, and deliver solutions.

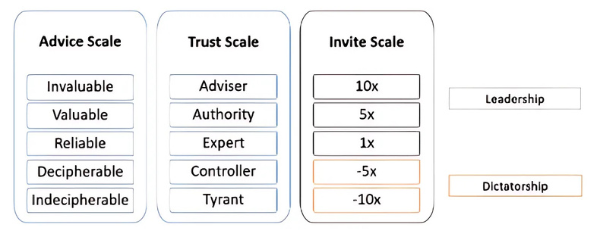

Consider the trust scale in the diagram below. Are you seen as a controller, like a financial controller, or an expert? If so you are not having the impact you could, you are not making the difference you know you can make.

The Persuasive Adviser Program: How to turn red tape into blue ribbon will give you all you need to make the difference you know you can make, to get invited to provide your advice 5 or 10 times more than you are now so you can create the change that is needed. While it covers so many of the traditional elements of a trusted adviser program such as listening and influencing skills it has so much more.

Learning Objectives

Here is what you will learn in the program:

How best to stand in the shoes of your stakeholders and internal clients, including the executives and the board.

How to paint them a picture to clarify and engage.

How to use stories to connect and inspire.

How best to ensure you have so much credibility, they cannot help but follow your advice.

Underlying each of these is the MCI Decision Model that is the subject of Bryan's book DECIDE How to Manage the Risk in Your Decision Making. The model is the key that will help you to unlock the door to the decision-making processes of those you are advising so you can deliver the right message at the right time to get the right decision.

Format of the Course

Two half-day online in-person Learning Workshops facilitated by Bryan Whitefield (4 hours for each of the 2 half-day online Learning Workshops). An interactive workshop series with ample time to participate, share and network.

About the Trainer

Bryan Whitefield

Director, Bryan Whitefield Consulting

Bryan Whitefield is a management consultant operating since 2001, specialising in risk-based decision making and influencing decision makers, born from his more than twenty years of facilitating executive and board workshops. Bryan’s experience as a risk practitioner includes the design and implementation of risk management programs for more than 150 organisations across the public, private and not-for- profit sectors. Bryan is the author of DECIDE: How to Manage the Risk in Your Decision Making, Persuasive Advising: How to Turn Red Tape into Blue Ribbon and Risky Business: How Successful Organisations Embrace Uncertainty (#1 Amazon Best Seller). Bryan was President and Chair of the RMIA from 2013 – 2015, is licenced as a Certified Chief Risk Officer (CCRO) and is the designer and facilitator of the RMIA’s flagship Enterprise Risk Course since 2019.

Why Bryan developed the Persuasive Adviser Program

Bryan knows that all advisers and those they advise face the same problem – giving and receiving valuable advice, succinctly, and with clarity. Read more here.

Click below to...

Download a brochure about the Persuasive Adviser Program

Download a paper about Persuasive Advising

E-mail Bryan to discuss a 1 or 2-day in-house program.

When you register for this course you agree to the RMIA passing your registration details onto our Training Partner, Bryan Whitefield Consulting.

Group Bookings: For Group Bookings, please contact us via email on pdp@rmia.org.au or by phone on 02 9095 2500.

Adaptive Cultures | Workshop | Storytelling for Impact in Risk Communication

Event Details

Date: 26 March 2026

Time: 9:00 am - 12:00 pm

Delivery: Online

Registration fee:

Member $440 incl GST

Non-member $550 incl GST

CPD Points: 4

About Event

The stories we tell and the case studies we share about risk and risk events can make an enormous impact on what people remember and how they respond to risks. In this seminar, Adaptive Cultures (Andrew and Deanna) will share story and narrative methodologies that can help lift risk awareness in your organisation. Topics include:

The brain science behind storytelling

Connecting the head and the heart through storytelling

Structuring stories for impact

Ways to share stories and case studies to reinforce the cultural journey

About the Trainers

DeAnna Burton

Adaptive Cultures - Risk Culture Practice Lead

DeAnna works with organisations and leaders to deepen the alignment of risk management, risk culture, and risk outcomes. She has over 20 years' financial services experience in Australia and the US in a variety of business arenas, including culture integration for a complex merger, designing a risk culture framework and initiatives to uplift risk culture maturity, survey design, senior leadership development programs and coaching.

Andrew Brown

Adaptive Cultures – Director and Co-Founder

Andrew is a director and co-founder of Adaptive Cultures. He has lectured, written, worked and consulted extensively in the field of risk management and risk culture. He believes that how we think about (and what we believe about) risk and consequences has a profound impact on ourselves, our organisations, our society and our planet. Andrew has held executive positions across the Asia Pacific region. These include Chief Actuary for AXA Life Singapore, Chief Financial Officer for Philippine AXA Life.

Note: As part of our ongoing commitment to provide valuable connections, we would like to inform you that the contact information provided during registration may be shared with our event sponsors. This is in accordance with our privacy policy and will be done solely for the purpose of fostering professional engagement and collaboration opportunities.

Risk 2 Solution | Graduate Certificate in Organisational Resilience, Risk and High Reliability (11056NAT) | Unit 2 schedule

Course Details

For more information on the course, please click here.

Duration:

The course runs for four units, online sessions, followed by independent study time to complete assessments.

Venue:

Online

2026 Dates:

Unit 1 - 27 Feb - 2 March 2026

Unit 2 - 10 - 13 April 2026

Unit 3 - 15 - 18 May 2026

Unit 4 - 26 - 29 June 2026

Costs:

RMIA Members $8,775.00 (incl GST)

Non-Members: $9,125.00 (incl GST)

CPD Points:

30 points

BWC | Enterprise Risk Management with Bryan Whitefield

Course Details

Duration: AEST (UTC+11:00)

SESSION 1 (4 hours)

1:00pm - 5:00pm - Monday, 13 April 2026

SESSION 2 (4 hours)

1:00pm - 5:00pm - Tuesday, 14 April 2026

Venue:

Online

Costs:

RMIA Members $1,875.00 (incl GST)

Non-Members $2,500.00 (incl GST)

CPD Points: 12

Welcome to the Enterprise Risk Management course, RMIA's signature course and a certification pre-requisite presented by our Training Partner, Bryan Whitefield Consulting.

About

All organisations, no matter whether private, government or not-for-profit have one thing in common – they all take risk to achieve their goals.

Unfortunately, too many organisations either don’t have any formal approach to considering the risks they are taking, or they utilise forms of risk management that are below par. That is, they are not in line with the principles and guidelines of better practice as defined in AS ISO 31000.

The purpose of the course is to provide you with the requisite knowledge to design, implement and operate enterprise risk programs for the successful management of organisational risk.

Course Overview

Introducing AS ISO 31000:2018

The course is aligned to the international standard on risk.

The standard is a guideline for any organisation that can be adapted to suit the needs of the organisation.

It provides principles, framework and process for managing organisational risk.

Learning Objectives

Understand the principles that underlie an efficient and effective approach to the management of organisational risk and the value it brings to the organisation.

Understand the core elements and benefits of a framework for integrating risk management into the governance and operations of an organisation.

Understanding of the risk management process and how to apply it to organisations of differing size and complexity.

Format of the Course

Please note that this course is now being delivered online. Attendees will receive a zoom invitation to participate in the 'face-to-face' aspect of the course online after registering. We can assure you that despite being online, we provide a high quality experience presented by Bryan Whitefield, a leader in the risk industry and a certified virtual presenter. To view testimonials on the success of Bryan's online RMIA tutorials here.

One Day Online Self-Paced Learning - Develop a technical understanding of ISO 31000

Two Half Day Online Learning Workshops facilitated by Bryan Whitefield

Clarify and embed technical understanding of ISO 31000

Tips and tricks on enterprise risk management including on:

Assessing the quality of an organisation’s approach to risk

What makes a good risk assessment

The key to communicating and consulting on risk

About the Trainer

Bryan Whitefield is a management consultant operating since 2001, specialising in risk-based decision making and influencing decision makers, born from his more than twenty years of facilitating executive and board workshops. Bryan’s experience as a risk practitioner includes the design and implementation of risk management programs for more than 150 organisations across the public, private and not-for- profit sectors. Bryan is the author of DECIDE: How to Manage the Risk in Your Decision Making, Persuasive Advising: How to Turn Red Tape into Blue Ribbon and Risky Business: How Successful Organisations Embrace Uncertainty (#1 Amazon Best Seller). Bryan was President and Chair of the RMIA from 2013 – 2015, is licenced as a Certified Chief Risk Officer (CCRO) and is the designer and facilitator of the RMIA’s flagship Enterprise Risk Course since 2019.

For more information on Bryan you can email him at bryan@bryanwhitefield.com or visit his website www.bryanwhitefield.com

Group Bookings: For Group Bookings, please contact us via email on pdp@rmia.org.au or by phone on 1300 775 648.

RMIA Accreditation Pathway: Upon completion of the RMIA's Enterprise Risk Management course, participants will be eligible to sit the exam to become a Certified Practising Risk Associate (CPRA®) or the Certified Practising Risk Manager (CPRM®) accreditation. To apply for Certification click here.

When you register for this course you agree to the RMIA passing your registration details onto our Training Partner, Bryan Whitefield Consulting.

Battleground | Resilience Starts Here: BIA & BCP Essentials

Course Details

Duration: AEST (UTC+10:00)

2:00pm - 5:30pm - Thursday, 14 May 2026

Venue:

Online

Costs:

RMIA Members $495.00 (incl GST)

Non-Members $715.00 (incl GST)

CPD Points: 4

About The Course

RMIA in partnership with our training partner Battleground are excited to present our newest course offering; Resilience Starts Here: BIA & BCP Essentials.

This course provides a comprehensive introduction to Business Impact Analysis (BIA) and Business Continuity Planning (BCP), essential practices for ensuring organisational resilience in the face of disruptions. Through four structured modules, attendees will explore the fundamentals and significance of BIA and BCP, gain practical skills in identifying critical business functions, and learn to assess risks and impacts from events such as cyberattacks or natural disasters. The course also covers the development of effective continuity strategies, assigning roles during crises, and implementing regular testing for ongoing improvement. By the end, participants will be equipped to build and sustain robust continuity frameworks.

Topics Covered

Module 1 – Introduction to Business Impact Analysis and Business Continuity Plan

What is BIA? What is BCP?

Identify the key components of both processes

Module 2 - Business Impact Analysis (BIA)

Understanding how to conduct a Business Impact Analysis (BIA)

Identify critical business functions and determine their impact during disruption

Module 3 - Business Continuity Planning (BCP)

Learning the key components of BCP

Develop strategies and maintaining operation during disruption

Module 4 - Implementation and Continuous Improvement

Understanding how to test and improve BCP

Learn best practices for ensuring resilience

About the Trainers

Helen Lipscombe - Helen is an expert resilience consultant with over 20 years of international experience. She specialises in business resilience, including risk management, crisis management, and business continuity. She has worked with public and private organizations, offering consultancy and strategic guidance to strengthen their resilience frameworks.

As a qualified trainer, Helen has designed and delivered comprehensive training programmes both internally and externally, equipping teams with the skills needed for business continuity and organisational resilience.

Helen is also a dedicated mentor for the Business Continuity Institute (BCI), where she supports individuals at various stages of their careers in developing their expertise in business continuity and resilience.

A passionate advocate for embedding resilience into organisational culture, she has spoken at events like BCI World and BCI Education Week. Additionally, Helen contributed to the revision of the BCI Good Practice Guide version 7.0, focusing on the Embracing Business Continuity chapter.

Jack Salkild - Jack is a resilience and emergency management consultant with deep operational and strategic experience across government and healthcare sectors. He specialises in business resilience, including emergency response, crisis management, governance, and business continuity. He has worked with multiple New South Wales government agencies, including Transport for NSW and the NSW Reconstruction Authority, delivering expertise on complex disaster projects and resilience frameworks.

With a background as an Intensive Care Paramedic and Clinical Educator at NSW Ambulance, Jack has led major incident response training, developed high-fidelity simulations, and coordinated multi-agency operational readiness programs. His work in government has included delivering structured governance and capability uplift initiatives for disaster recovery at a state level.

As a consultant at Battleground, Jack works closely with organisations to enhance their resilience capabilities through tailored solutions. His focus includes business impact analyses, continuity planning, crisis governance, and embedding resilience into operational practice.

Jack brings a practical systems-based mindset, drawing on lived frontline experience and a strong understanding of organisational risk. He is passionate about supporting organisations to build resilience in the face of complex disruptions and cascading challenges.

Group Bookings: For Group Bookings, please contact us via email on pdp@rmia.org.au or by phone on 1300 775 648.

When you register for this course you agree to the RMIA passing your registration details onto our Training Partner, Battleground.

Risk 2 Solution | Graduate Certificate in Organisational Resilience, Risk and High Reliability (11056NAT) | Unit 3 schedule

Course Details

For more information on the course, please click here.

Duration:

The course runs for four units, online sessions, followed by independent study time to complete assessments.

Venue:

Online

2026 Dates:

Unit 1 - 27 Feb - 2 March 2026

Unit 2 - 10 - 13 April 2026

Unit 3 - 15 - 18 May 2026

Unit 4 - 26 - 29 June 2026

Costs:

RMIA Members $8,775.00 (incl GST)

Non-Members: $9,125.00 (incl GST)

CPD Points:

30 points

BWC | Mastering Risk Workshop Facilitation

Course Details

Duration: AEST (UTC+10:00)

SESSION 1 (4 hours)

9:00am - 1:00pm Thursday, 21 May 2026

SESSION 2 (4 hours)

9:00am - 1:00pm Friday, 22 May 2026

Delivery: Online

Costs:

RMIA Members $1,440.00 (incl GST)

Non-Members $1,725.00 (incl GST)

CPD Points: 12

Come experience this immersive workshop, presented by our Training Partner - Bryan Whitefield Consulting, that will provide you with the confidence to tackle the online environment while building your skill set for the future.

Modified for online facilitation using a range of collaboration tools that will make sure your workshops are engaging and effective.

About

This course is for risk professionals seeking mastery in risk workshop facilitation. To move beyond mechanical processes for collecting a list of risks. You will be given a process for preparing for engaging workshops, shown techniques for facilitating effective conversations and be introduced to a range of tools to provide insights to the business so they can make better sense of their world.. As a result, you will be more valued, more trusted, and will be invited to provide your advice before decisions are made.

Course Overview

Two half-day online interactive workshops with ample time to participate and practice your facilitation skills.

One: Preparation

Objectives – Context and scope

Team – Politics, culture and capability

Facility – Optimising and working with constraints

Analysis – Tools and techniques to provide insights

Two: Facilitation

Framing – Introducing, confirming and clarifying

Conversations – Initiating, guiding and ending

Tipping points – Navigating dominance, bias and silence

Collation – Priorities, breadth and depth

Three: Post-Mortem

Objectives check – Alignment with values and goals

Reality check – Fact check, resource check, pub-test check

Learning Objectives

How to prepare for a workshop to maximise the value delivered to participants.

Understand the key to an engaging workshop no matter the participants, the location or the time available.

Learn how to deliver strong insights to decision makers before, during and after the workshop.

Experience the value of key tools and techniques for managing politics, bias and difficult people.

Format of the Course

Online run over two half-days. An interactive workshop with ample time to participate, share and network.

About the Trainer

Bryan Whitefield is a management consultant operating since 2001, specialising in risk-based decision making and influencing decision makers, born from his more than twenty years of facilitating executive and board workshops. Bryan’s experience as a risk practitioner includes the design and implementation of risk management programs for more than 150 organisations across the public, private and not-for- profit sectors. Bryan is the author of DECIDE: How to Manage the Risk in Your Decision Making, Persuasive Advising: How to Turn Red Tape into Blue Ribbon and Risky Business: How Successful Organisations Embrace Uncertainty (#1 Amazon Best Seller). Bryan was President and Chair of the RMIA from 2013 – 2015, is licenced as a Certified Chief Risk Officer (CCRO) and is the designer and facilitator of the RMIA’s flagship Enterprise Risk Course since 2019.

For more information on Bryan you can email him at bryan@bryanwhitefield.com or visit his website www.bryanwhitefield.com

Group Bookings: For Group Bookings, please contact us via email on pdp@rmia.org.au or by phone on 1300 775 648.

When you register for this course you agree to the RMIA passing your registration details onto our Training Partner, Bryan Whitefield Consulting.

BWC | Enterprise Risk Management with Lauren Jones

Course Details

Duration: AEST (UTC+10:00)

SESSION 1 (4 hours)

09:00am - 1:00pm - Thursday 28 May 2026

SESSION 2 (4 hours)

09:00am - 1:00pm - Friday 29 May 2026

Costs:

RMIA Members $1,875.00 (incl GST)

Non-Members $2,500.00 (incl GST)

CPD Points: 12

Welcome to the Enterprise Risk Management course, RMIA's signature course and a certification pre-requisite presented by our Training Partner, Bryan Whitefield Consulting.

About

All organisations, no matter whether private, government or not-for-profit have one thing in common – they all take risk to achieve their goals.

Unfortunately, too many organisations either don’t have any formal approach to considering the risks they are taking, or they utilise forms of risk management that are below par. That is, they are not in line with the principles and guidelines of better practice as defined in AS ISO 31000.

The purpose of the course is to provide you with the requisite knowledge to design, implement and operate enterprise risk programs for the successful management of organisational risk.

Course Overview

Introducing AS ISO 31000:2018

The course is aligned to the international standard on risk.

The standard is a guideline for any organisation that can be adapted to suit the needs of the organisation.

It provides principles, framework and process for managing organisational risk.

Learning Objectives

Understand the principles that underlie an efficient and effective approach to the management of organisational risk and the value it brings to the organisation.

Understand the core elements and benefits of a framework for integrating risk management into the governance and operations of an organisation.

Understanding of the risk management process and how to apply it to organisations of differing size and complexity.

Format of the Course

Please note that this course is now being delivered online. Attendees will receive a zoom invitation to participate in the 'face-to-face' aspect of the course online after registering. We can assure you that despite being online, we provide a high quality experience presented by Bryan Whitefield, a leader in the risk industry and a certified virtual presenter. To view testimonials on the success of Bryan's online RMIA tutorials here.

One Day Online Self-Paced Learning - Develop a technical understanding of ISO 31000

Two Half Day Online Learning Workshops facilitated by Lauren Jones

Clarify and embed technical understanding of ISO 31000

Tips and tricks on enterprise risk management including on:

Assessing the quality of an organisation’s approach to risk

What makes a good risk assessment

The key to communicating and consulting on risk

About the Trainer

Lauren Jones

Trainer, Bryan Whitefield Consulting

Lauren Jones is a facilitator, trainer and expert in helping leaders build sustainable businesses, with over 30 years of experience working with C level executives, business owners and leaders. Her experience specialising in strategic facilitation, skills development, systems implementation and continual improvement for organisations has increased clarity and focus on outcomes, built efficiency and increased profitability with her clients.

Over the past decade Lauren has facilitated numerous risk workshops and has designed and implemented risk management programs for a multitude of organisations across diverse industries such as construction, infrastructure and manufacturing.

Lauren has authored a recently released book: 10% BETTER: Taking Organisations from Ordinary to Excellent written for leaders who want to build resilience for their organisations to sustain change and challenge, and be a legacy into the future. For more information on Lauren you can email her on lauren@laurenjones.com.au or visit her website www.laurenjones.com.au

Group Bookings: For Group Bookings, please contact us via email on pdp@rmia.org.au or by phone on 1300 775 648.

RMIA Accreditation Pathway: Upon completion of the RMIA's Enterprise Risk Management course, participants will be eligible to sit the exam to become a Certified Practising Risk Associate (CPRA®) or the Certified Practising Risk Manager (CPRM®) accreditation. To apply for Certification click here.

When you register for this course you agree to the RMIA passing your registration details onto our Training Partner, Bryan Whitefield Consulting.

Risk 2 Solution | Graduate Certificate in Organisational Resilience, Risk and High Reliability (11056NAT) | Unit 4 schedule

Course Details

For more information on the course, please click here.

Duration:

The course runs for four units, online sessions, followed by independent study time to complete assessments.

Venue:

Online

2026 Dates:

Unit 1 - 27 Feb - 2 March 2026

Unit 2 - 10 - 13 April 2026

Unit 3 - 15 - 18 May 2026

Unit 4 - 26 - 29 June 2026

Costs:

RMIA Members $8,775.00 (incl GST)

Non-Members: $9,125.00 (incl GST)

CPD Points:

30 points

Battleground | Embedding Resilience: Essentials of Training, Awareness & Exercising

Course Details

Duration: AEST (UTC+10:00)

2:00pm - 5:30pm - Thursday 16 July 2026

Venue:

Online

Costs:

RMIA Members $495.00 (incl GST)

Non-Members $715.00 (incl GST)

CPD Points: 4

About The Course

Embedding Resilience: Essentials of Training, Awareness & Exercising is a practical, insight-rich program designed to help risk professionals embed continuity and resilience practices across all levels of their organisation. Drawing on global standards such as ISO 22301 and the BCI Good Practice Guidelines (GPG), this course explores how to design and deliver effective training, build awareness that resonates, and run exercises that prepare your teams for disruption.

Topics Covered

What ISO 22301 and BCI GPG say about training, awareness and exercising

How to tailor continuity learning for executives, team leaders, and frontline staff

How to make awareness campaigns memorable and relevant

Types of exercises — from quick wins to full simulations — and how to get started

How to track, evaluate, and improve your training and exercising efforts

About the Trainers

Helen Lipscombe - Helen is an expert resilience consultant with over 20 years of international experience. She specialises in business resilience, including risk management, crisis management, and business continuity. She has worked with public and private organizations, offering consultancy and strategic guidance to strengthen their resilience frameworks.

As a qualified trainer, Helen has designed and delivered comprehensive training programmes both internally and externally, equipping teams with the skills needed for business continuity and organisational resilience.

Helen is also a dedicated mentor for the Business Continuity Institute (BCI), where she supports individuals at various stages of their careers in developing their expertise in business continuity and resilience.

A passionate advocate for embedding resilience into organisational culture, she has spoken at events like BCI World and BCI Education Week. Additionally, Helen contributed to the revision of the BCI Good Practice Guide version 7.0, focusing on the Embracing Business Continuity chapter.

Jack Salkild - Jack is a resilience and emergency management consultant with deep operational and strategic experience across government and healthcare sectors. He specialises in business resilience, including emergency response, crisis management, governance, and business continuity. He has worked with multiple New South Wales government agencies, including Transport for NSW and the NSW Reconstruction Authority, delivering expertise on complex disaster projects and resilience frameworks.

With a background as an Intensive Care Paramedic and Clinical Educator at NSW Ambulance, Jack has led major incident response training, developed high-fidelity simulations, and coordinated multi-agency operational readiness programs. His work in government has included delivering structured governance and capability uplift initiatives for disaster recovery at a state level.

As a consultant at Battleground, Jack works closely with organisations to enhance their resilience capabilities through tailored solutions. His focus includes business impact analyses, continuity planning, crisis governance, and embedding resilience into operational practice.

Jack brings a practical systems-based mindset, drawing on lived frontline experience and a strong understanding of organisational risk. He is passionate about supporting organisations to build resilience in the face of complex disruptions and cascading challenges.

Group Bookings: For Group Bookings, please contact us via email on pdp@rmia.org.au or by phone on 1300 775 648.

When you register for this course you agree to the RMIA passing your registration details onto our Training Partner, Battleground.

Battleground | Crisis Ready: Building Confidence, Clarity & Control When It Matters Most

Course Details

Duration: AEST (UTC+10:00)

2:00pm - 5:30pm - Thursday 10 September

Venue:

Online

Costs:

RMIA Members $495.00 (incl GST)

Non-Members $715.00 (incl GST)

CPD Points: 4

About The Course

RMIA, in partnership with our training provider Battleground, proudly presents Crisis Ready: Building Confidence, Clarity & Control When It Matters Most—an essential introductory course in crisis management. This course is designed to equip participants with the foundational skills to respond effectively when a crisis strikes.

Participants will engage with structured frameworks and practical tools to build crisis resilience and leadership readiness—ensuring teams can act with confidence, clarity, and control in high-pressure situations.

Topics Covered

Define a crisis, distinguishing it clearly from emergencies or incidents—and understand why that distinction is critical

Identify and assemble the key components of an effective crisis management framework

Use structured decision-making tools to deliver rapid, ethical responses under pressure

Communicate clearly and effectively with stakeholders during a crisis

Structure, train, and activate a Crisis Management Team (CMT) with speed and efficiency

About the Trainers

Helen Lipscombe - Helen is an expert resilience consultant with over 20 years of international experience. She specialises in business resilience, including risk management, crisis management, and business continuity. She has worked with public and private organizations, offering consultancy and strategic guidance to strengthen their resilience frameworks.

As a qualified trainer, Helen has designed and delivered comprehensive training programmes both internally and externally, equipping teams with the skills needed for business continuity and organisational resilience.

Helen is also a dedicated mentor for the Business Continuity Institute (BCI), where she supports individuals at various stages of their careers in developing their expertise in business continuity and resilience.

A passionate advocate for embedding resilience into organisational culture, she has spoken at events like BCI World and BCI Education Week. Additionally, Helen contributed to the revision of the BCI Good Practice Guide version 7.0, focusing on the Embracing Business Continuity chapter.

Jack Salkild - Jack is a resilience and emergency management consultant with deep operational and strategic experience across government and healthcare sectors. He specialises in business resilience, including emergency response, crisis management, governance, and business continuity. He has worked with multiple New South Wales government agencies, including Transport for NSW and the NSW Reconstruction Authority, delivering expertise on complex disaster projects and resilience frameworks.

With a background as an Intensive Care Paramedic and Clinical Educator at NSW Ambulance, Jack has led major incident response training, developed high-fidelity simulations, and coordinated multi-agency operational readiness programs. His work in government has included delivering structured governance and capability uplift initiatives for disaster recovery at a state level.

As a consultant at Battleground, Jack works closely with organisations to enhance their resilience capabilities through tailored solutions. His focus includes business impact analyses, continuity planning, crisis governance, and embedding resilience into operational practice.

Jack brings a practical systems-based mindset, drawing on lived frontline experience and a strong understanding of organisational risk. He is passionate about supporting organisations to build resilience in the face of complex disruptions and cascading challenges.

Group Bookings: For Group Bookings, please contact us via email on pdp@rmia.org.au or by phone on 1300 775 648.

When you register for this course you agree to the RMIA passing your registration details onto our Training Partner, Battleground.

BWC | Enterprise Risk Management with Lauren Jones

Course Details

Duration: AEDT (UTC+11:00)

SESSION 1 (4 hours)

09:00am - 1:00pm - Thursday 5 February 2026

SESSION 2 (4 hours)

09:00am - 1:00pm - Friday 6 February 2026

Costs:

RMIA Members $1,875.00 (incl GST)

Non-Members $2,500.00 (incl GST)

CPD Points: 12

Welcome to the Enterprise Risk Management course, RMIA's signature course and a certification pre-requisite presented by our Training Partner, Bryan Whitefield Consulting.

About

All organisations, no matter whether private, government or not-for-profit have one thing in common – they all take risk to achieve their goals.

Unfortunately, too many organisations either don’t have any formal approach to considering the risks they are taking, or they utilise forms of risk management that are below par. That is, they are not in line with the principles and guidelines of better practice as defined in AS ISO 31000.

The purpose of the course is to provide you with the requisite knowledge to design, implement and operate enterprise risk programs for the successful management of organisational risk.

Course Overview

Introducing AS ISO 31000:2018

The course is aligned to the international standard on risk.

The standard is a guideline for any organisation that can be adapted to suit the needs of the organisation.

It provides principles, framework and process for managing organisational risk.

Learning Objectives

Understand the principles that underlie an efficient and effective approach to the management of organisational risk and the value it brings to the organisation.

Understand the core elements and benefits of a framework for integrating risk management into the governance and operations of an organisation.

Understanding of the risk management process and how to apply it to organisations of differing size and complexity.

Format of the Course

Please note that this course is now being delivered online. Attendees will receive a zoom invitation to participate in the 'face-to-face' aspect of the course online after registering. We can assure you that despite being online, we provide a high quality experience presented by Bryan Whitefield, a leader in the risk industry and a certified virtual presenter. To view testimonials on the success of Bryan's online RMIA tutorials here.

One Day Online Self-Paced Learning - Develop a technical understanding of ISO 31000

Two Half Day Online Learning Workshops facilitated by Lauren Jones

Clarify and embed technical understanding of ISO 31000

Tips and tricks on enterprise risk management including on:

Assessing the quality of an organisation’s approach to risk

What makes a good risk assessment

The key to communicating and consulting on risk

About the Trainer

Lauren Jones

Trainer, Bryan Whitefield Consulting

Lauren Jones is a facilitator, trainer and expert in helping leaders build sustainable businesses, with over 30 years of experience working with C level executives, business owners and leaders. Her experience specialising in strategic facilitation, skills development, systems implementation and continual improvement for organisations has increased clarity and focus on outcomes, built efficiency and increased profitability with her clients.

Over the past decade Lauren has facilitated numerous risk workshops and has designed and implemented risk management programs for a multitude of organisations across diverse industries such as construction, infrastructure and manufacturing.

Lauren has authored a recently released book: 10% BETTER: Taking Organisations from Ordinary to Excellent written for leaders who want to build resilience for their organisations to sustain change and challenge, and be a legacy into the future. For more information on Lauren you can email her on lauren@laurenjones.com.au or visit her website www.laurenjones.com.au

Group Bookings: For Group Bookings, please contact us via email on pdp@rmia.org.au or by phone on 1300 775 648.

RMIA Accreditation Pathway: Upon completion of the RMIA's Enterprise Risk Management course, participants will be eligible to sit the exam to become a Certified Practising Risk Associate (CPRA®) or the Certified Practising Risk Manager (CPRM®) accreditation. To apply for Certification click here.

When you register for this course you agree to the RMIA passing your registration details onto our Training Partner, Bryan Whitefield Consulting.

RMIA SA/NT Chapter | Risk Social | End of Year Drinks and Celebration of 2025 Mentoring Program

Event Details

Time: 5:30 pm - onwards

Date: 4 December 2025

Venue: Riskonnect, Inc. | 391 King William Street, Adelaide, SA

Registration Fee: Free

Sponsored by:

About Event

Join us for a celebratory evening to wrap up the year with fellow risk professionals from across South Australia and the Northern Territory. Hosted by the RMIA SA/NT Chapter and proudly sponsored by Riskonnect, this is a chance to reflect on the year, reconnect with peers, and toast to the future of risk management.

Whether you’re winding down or gearing up for 2026, we’d love to see you there. Let’s raise a glass to the achievements, challenges, and connections that shaped our year.

We will also take the opportunity to celebrate our latest round of mentors and mentees!

Moderated by

Zoe Joyce

SA/NT President

RMIA NSW Chapter | End-of-Year Celebration

Event Details

Time: 5:30pm AEDT - onwards

Date: 3 December 2025

Venue: The Sussex Hotel, Rooftop

Registration Fee: $25 Members | $35 Non-members (incl GST)

About the Event

Come together with the NSW Chapter Committee for a relaxed and festive evening to celebrate a great year and all things Christmas.

The Learning Pyramid | Workshop | Influencing Foundations for Risk Professionals

Event Details

Date: 3 December 2025

Time: 9:00am - 12:30pm AEDT

Delivery: Online

Registration fee:

Member $495 incl GST

Non-member $715 incl GST

CPD Points: 4

About Event

After receiving overwhelmingly positive feedback from the delivery of Influencing Essentials at the 2025 RMIA Conference, we are thrilled to launch our brand-new professional development offering, Influencing Foundations for Risk Professionals. This course is for risk managers looking to enhance their communication skills and become more effective influencers. The ability to influence individuals, teams, customers, and stakeholders is a critical aspect of a risk manager's role, fostering agreement and alignment with key perspectives and proposals. By mastering the art of influencing outcomes while preserving strong relationships, participants will be better equipped to effectively drive successful strategic decision making and action.

Topics Covered

Establishing trust and rapport

Finding the starting point

Principles of influence.

Planning the interaction

Structuring influencing conversations

Learning Outcomes

Apply influencing with an ethical approach

Communicate through verbal and non-verbal channels

Use key skills including active listening and perspective taking

Establish trust, rapport and credibility to negotiate win-win outcomes

Apply principles of influence to expand their sphere of influence.

Structure conversations for optimal influencing and persuasion

Use information effectively for influencing

Facilitator

Lisa Harrison - Lisa is a talented, highly experienced and versatile Learning and Development Consultant. She specialises in creating measurable and sustainable behaviour change through learning solutions in the areas of communication, management and leadership, and facilitation. For over 19 years in L&D she has shown has a remarkable ability to partner with clients both internal and external: to analyse needs, create and deliver solutions, and engage learners from a wide variety of backgrounds to achieve ‘life-long’ and ‘life-wide’ learning.

As a learning and organisational development professional with extensive experience in staff engagement and development, Lisa combines extensive learning expertise with leadership and management experience to create an approach to learning that is highly energising and effective across all aspects of business.

Lisa’s expertise in training delivery and design has been developed over many years through a variety of learning and development projects, including organisational consulting, end-to-end learning solutions, corporate and vocational learning, and a range of delivery methods including blended, face-to-face and technology platforms.

Her approach to learning is client-focussed, experiential and active participation in learning, and facilitation based, underpinned with a deep understanding of adult learning and the psychology of motivation and engagement.

As well as holding Certificate IV qualifications, Lisa has also designed, trained and assessed others in Cert IV Training and Assessment, Frontline Management, and Business.

RMIA x ORCS | The Organisational Risk Culture Standard (ORCS): Redefining How We Understand and Measure Risk Culture

Event Details

Time: 12:30pm - 1:30pm AEDT

Date: 2 December 2025

Venue: Online

Registration Fee: Free

About the Event

Organisational culture shapes how risk is perceived, communicated, and managed – yet until now, few tools have effectively measured it. The Organisational Risk Culture Standard (ORCS) is a world-first framework designed to help organisations understand, assess, and strengthen their risk culture in a structured and evidence-based way. Developed by leading experts in risk and behavioural science, the ORCS bridges the gap between governance, leadership, and human behaviour, offering practical guidance for boards, executives, and risk professionals.

In this session, Jack Jones and Dr Paul Johnston – two of the ORCS authors – will share insights on the development and real-world application of the standard. Hosted by Simon Levy, CEO of RMIA, the discussion will explore how the ORCS empowers organisations to turn risk culture into a strategic advantage and create more resilient, high-performing teams. Learn more about the ORCS at www.riskculture.org.

About the Speakers

Jack Jones

Risk Management Executive, Co-Author of the ORCS

Jack has over thirty-seven years of experience in cybersecurity, ten years of which as a CISO. He created the “Factor Analysis of Information Risk” (FAIR) and FAIR-CAM models which have been adopted as international standards for risk measurement. Jack’s also won several industry awards, including a Lifetime Achievement award. In 2016, Jack co-founded the FAIR Institute, which is an award winning, global non-profit dedicated to advancing the field of risk management.

Currently, Jack teaches in Carnegie Mellon University’s CISO executive program and provides strategic guidance to companies. https://riskculture.org/authors/jack-jones/

Paul Johnston

Behavioural Scientist and Risk Management Specialist, Co-Author of the ORCS

National Practice Lead (Risk Management Capability & Culture) for the Risk 2 Solution Group, Dr Paul Johnston FARPI FISRM ChFInstP ChOHSP CMAS RPP MATMA is a Behavioural Scientist with over 30 years of HSES (Health, Safety, Environment & Security) risk management experience in both the public and private sectors. Holding a PhD in Public Safety Risk Management, a Graduate Certificate in Occupational Hygiene Engineering, and a Bachelor of Behavioural Science, Paul has provided operational, management system consulting, research & analysis, and training/facilitation services to a wide range of industry groups throughout Australia and internationally.

A self-confessed “pracademic”, Paul is also the Academic Lead for the Institute of Presilience, as well as being a senior researcher with the ASRC (Australian Security Research Centre), and is the Editor of the ISRM (Institute of Strategic Risk Management) Journal. https://riskculture.org/authors/dr-paul-johnston/

Simon Levy

Chief Executive Officer, RMIA

Simon has 20 years of experience as a risk professional and has collaborated closely with senior executives for globally recognised brands and organisations contributing to strategic intent by ensuring accountability for effective risk mitigation.

BWC | Enterprise Risk Management with Bryan Whitefield

Course Details

Duration: AEDT (UTC+11:00)

SESSION 1 (4 hours)

1:00pm - 5:00pm - Monday, 1 December 2025

SESSION 2 (4 hours)

1:00pm - 5:00pm - Tuesday, 2 December 2025

Venue:

Online

Costs:

RMIA Members $1,875.00 (incl GST)

Non-Members $2,500.00 (incl GST)

CPD Points: 12

Welcome to the Enterprise Risk Management course, RMIA's signature course and a certification pre-requisite presented by our Training Partner, Bryan Whitefield Consulting.

About

All organisations, no matter whether private, government or not-for-profit have one thing in common – they all take risk to achieve their goals.

Unfortunately, too many organisations either don’t have any formal approach to considering the risks they are taking, or they utilise forms of risk management that are below par. That is, they are not in line with the principles and guidelines of better practice as defined in AS ISO 31000.

The purpose of the course is to provide you with the requisite knowledge to design, implement and operate enterprise risk programs for the successful management of organisational risk.

Course Overview

Introducing AS ISO 31000:2018

The course is aligned to the international standard on risk.

The standard is a guideline for any organisation that can be adapted to suit the needs of the organisation.

It provides principles, framework and process for managing organisational risk.

Learning Objectives

Understand the principles that underlie an efficient and effective approach to the management of organisational risk and the value it brings to the organisation.

Understand the core elements and benefits of a framework for integrating risk management into the governance and operations of an organisation.

Understanding of the risk management process and how to apply it to organisations of differing size and complexity.

Format of the Course

Please note that this course is now being delivered online. Attendees will receive a zoom invitation to participate in the 'face-to-face' aspect of the course online after registering. We can assure you that despite being online, we provide a high quality experience presented by Bryan Whitefield, a leader in the risk industry and a certified virtual presenter. To view testimonials on the success of Bryan's online RMIA tutorials here.

One Day Online Self-Paced Learning - Develop a technical understanding of ISO 31000

Two Half Day Online Learning Workshops facilitated by Bryan Whitefield

Clarify and embed technical understanding of ISO 31000

Tips and tricks on enterprise risk management including on:

Assessing the quality of an organisation’s approach to risk

What makes a good risk assessment

The key to communicating and consulting on risk

About the Trainer

Bryan Whitefield is a management consultant operating since 2001, specialising in risk-based decision making and influencing decision makers, born from his more than twenty years of facilitating executive and board workshops. Bryan’s experience as a risk practitioner includes the design and implementation of risk management programs for more than 150 organisations across the public, private and not-for- profit sectors. Bryan is the author of DECIDE: How to Manage the Risk in Your Decision Making, Persuasive Advising: How to Turn Red Tape into Blue Ribbon and Risky Business: How Successful Organisations Embrace Uncertainty (#1 Amazon Best Seller). Bryan was President and Chair of the RMIA from 2013 – 2015, is licenced as a Certified Chief Risk Officer (CCRO) and is the designer and facilitator of the RMIA’s flagship Enterprise Risk Course since 2019.

For more information on Bryan you can email him at bryan@bryanwhitefield.com or visit his website www.bryanwhitefield.com

Group Bookings: For Group Bookings, please contact us via email on pdp@rmia.org.au or by phone on 1300 775 648.

RMIA Accreditation Pathway: Upon completion of the RMIA's Enterprise Risk Management course, participants will be eligible to sit the exam to become a Certified Practising Risk Associate (CPRA®) or the Certified Practising Risk Manager (CPRM®) accreditation. To apply for Certification click here.

When you register for this course you agree to the RMIA passing your registration details onto our Training Partner, Bryan Whitefield Consulting.

Risk 2 Solution | Graduate Certificate in Organisational Resilience, Risk and High Reliability (11056NAT) | Unit 4 schedule

Course Details

Duration:

The course runs for four units, online sessions, followed by independent study time to complete assessments.

Venue:

Online

2025 Dates:

Unit 1 – 18-21 July 2025

Unit 2 – 5-8 September 2025

Unit 3 – 17-20 October 2025

Unit 4 – 28 November-1 December 2025

Costs:

RMIA Members $8,775.00 (incl GST)

Non-Members: $9,125.00 (incl GST)

CPD Points:

30 points

Register Here

Please click here to register.

RMIA VIC Chapter | End-of-Year Celebration

Event Details

Time: 4:30pm - 6:30pm AEDT

Date: 27 November 2025

Venue: Taxi Kitchen, Transport Hotel, Level 1

Registration Fee: $25 Members | $35 Non-members (incl GST)

About the Event

Join fellow risk professionals from across Victoria for a well-earned celebration as we close out 2025.

After another year of navigating uncertainties, managing emerging threats, and strengthening organisational resilience, it’s time to unwind and reconnect with peers who truly understand the challenges and triumphs of our profession.

No presentations or formalities, just good company, great conversation, and the chance to reflect on the year gone by while looking ahead to 2026.

A welcome drink and light refreshments will be provided.

All risk professionals are welcome, members and non-members alike.

Moderator

Rachelle Tippett

RMIA VIC Chapter President

Riskonnect Webinar | What APAC Leaders Told Us About GRC and Data Challenges

Event Details

Time: 10:30am - 11:30am AEDT

Date: 27 November 2025

Venue: Demio

Registration Fee: FREE

About the Event

Across the Asia-Pacific region, organisations continue to face growing complexity in governance, risk, and compliance (GRC). From regulatory pressures to fragmented data systems, many are still struggling to achieve full visibility, accountability, and alignment.

Based on a 2025 survey of 100 risk and resilience professionals across the APAC region, this webinar explores where organisations are falling behind and how to strengthen GRC foundations for the decade ahead.

Join us to learn:

Why over 50% of organisations say their risk management is not aligned with organisational goals and strategic objectives

How 35% still take a reactive approach to GRC, leaving critical gaps in visibility and response

The impact of poor data governance and siloed systems, with 48% citing unreliable reporting

Practical ways to build data integrity, enable real-time insight, and foster accountability across teams

How to build a unified, data-driven GRC ecosystem that supports agility, compliance, and resilience

This session is ideal for GRC, resilience, and compliance professionals who want to see how their organisation compares with others across APAC and learn practical ways to close common gaps in GRC and data management.

About the Speakers

Matthew Meldrum